In today’s competitive business landscape, acquiring clients, managing a budget, and implementing money-saving techniques are crucial for success. This guide will provide comprehensive strategies to help you excel in these areas.

How to Get Clients

1. Identify Your Target Audience

Knowing who your ideal clients are is the first step. Define your target audience based on demographics, interests, and needs. This will help you tailor your marketing efforts more effectively.

2. Leverage Social Media

Social media platforms like LinkedIn, Facebook, and Instagram are powerful tools for reaching potential clients. Create engaging content, join relevant groups, and interact with your audience to build relationships.

3. Networking

Attend industry events, conferences, and webinars to meet potential clients. Networking can lead to valuable connections and opportunities.

4. Offer Free Value

Provide free resources such as eBooks, webinars, or consultations to showcase your expertise. This can attract potential clients and demonstrate the value you can offer.

5. Ask for Referrals

Encourage satisfied clients to refer your services to others. Word-of-mouth recommendations are often highly trusted and can lead to new business.

Budget Planning

1. Set Clear Financial Goals

Determine what you want to achieve financially in the short and long term. Clear goals will guide your budgeting process and help you stay focused.

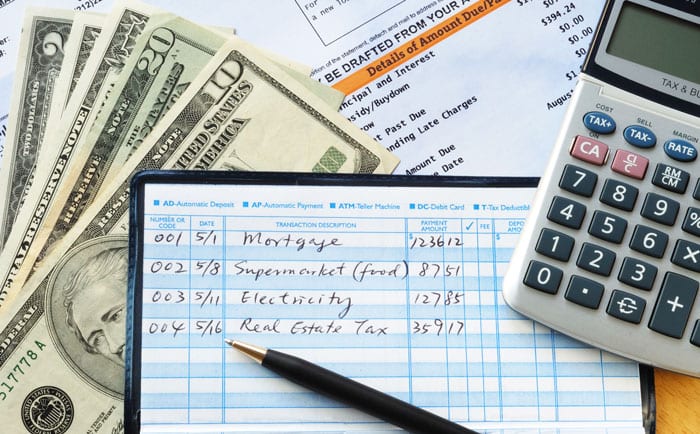

2. Track Your Income and Expenses

Use tools like spreadsheets or budgeting apps to monitor your cash flow. Keeping track of every dollar earned and spent will provide a clear picture of your financial health.

3. Create a Realistic Budget

Based on your financial goals and tracking data, create a budget that allocates funds for essential expenses, savings, and discretionary spending. Make sure your budget is realistic and adaptable.

4. Prioritize Expenses

Identify and prioritize your expenses. Focus on essentials such as rent, utilities, and salaries first. Allocate remaining funds to savings and other areas as needed.

5. Review and Adjust Regularly

Regularly review your budget to ensure you are on track. Adjust your budget as necessary to accommodate changes in your financial situation or goals.

Money-Saving Techniques

1. Reduce Unnecessary Expenses

Evaluate your spending habits and identify areas where you can cut costs. This might include subscriptions you don’t use, dining out less frequently, or finding cheaper alternatives for products and services.

2. Negotiate with Vendors

Don’t hesitate to negotiate with vendors for better rates on products and services. You might be surprised at how much you can save with a little negotiation.

3. Implement Energy-Saving Measures

Reducing energy consumption can lead to significant savings. Implement energy-saving measures such as using energy-efficient appliances, turning off lights when not in use, and optimizing heating and cooling systems.

4. Buy in Bulk

Purchasing items in bulk can often result in lower per-unit costs. This is particularly useful for non-perishable goods that you use regularly.

5. Automate Savings

Set up automatic transfers to your savings account. This ensures that a portion of your income is consistently saved, helping you build a financial cushion over time.

Table of Differences

| Aspect | Getting Clients | Budget Planning | Money-Saving Techniques |

|---|---|---|---|

| Focus | Acquiring new clients | Managing financial resources | Reducing expenses |

| Key Activities | Networking, social media, referrals | Setting goals, tracking income/expenses | Cutting unnecessary costs, negotiating |

| Tools | Social media, events, referrals | Spreadsheets, budgeting apps | Energy-saving measures, bulk buying |

| Primary Goal | Business growth | Financial stability | Increasing savings |

| Frequency of Review | Regular interaction and engagement | Periodic financial reviews | Ongoing evaluation of expenses |

FAQs

1. How can I identify my target audience effectively?

To identify your target audience, conduct market research, analyze your existing customer base, and create buyer personas. This will help you understand their demographics, interests, and needs.

2. What are some effective social media strategies for getting clients?

Engage with your audience through regular posts, use targeted ads, join relevant groups, and share valuable content. Consistency and interaction are key to building relationships on social media.

3. How often should I review and adjust my budget?

Review your budget monthly to ensure you are on track. Adjust it as necessary to reflect changes in your financial situation, goals, or unexpected expenses.

4. What are some common areas where businesses can reduce expenses?

Common areas include unnecessary subscriptions, office supplies, energy consumption, and travel expenses. Regularly evaluate your spending to identify potential savings.

5. How can I negotiate better rates with vendors?

Research market rates, build good relationships with vendors, and be prepared to discuss your needs and budget. Demonstrating loyalty and long-term potential can also help in negotiations.

Conclusion

- Identify your target audience to tailor marketing efforts effectively.

- Leverage social media for client acquisition and engagement.

- Network and offer free value to showcase expertise.

- Set clear financial goals and track income/expenses.

- Create a realistic budget and prioritize essential expenses.

- Regularly review and adjust your budget to stay on track.

- Reduce unnecessary expenses and negotiate with vendors.

- Implement energy-saving measures and buy in bulk.

- Automate savings to build a financial cushion.

Relevant Posts

- Telephone Mystery Shopper Jobs from Home

- Grant Writer Job Description at Conga Kids, Los Angeles, CA

By applying these strategies, you can attract more clients, effectively manage your budget, and save money. Success in these areas will contribute to the overall growth and stability of your business.